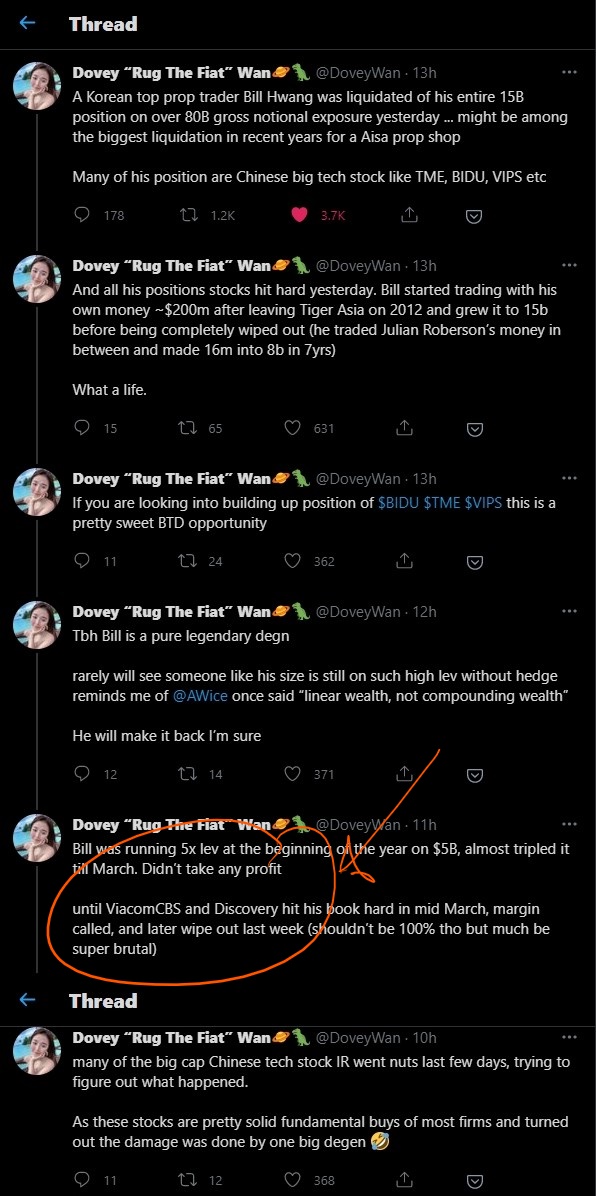

According to a tweet thread by @DoveyWan, Bill Hwang’s entire $15B portfolio (covering $80B notional–over 5 times leverage) was liquidated on Friday (Goldman sold $10.5 bln of stocks in block-trade spree- Bloomberg News | Reuters).

As alarming as one trader taking so many companies down by 40% in three days is the comment that he was doing well “until ViacomCBS and Discovery hit his book hard in mid March, margin called, and later wipe out last week.” (sic) In the context of the run up since November, the “hit his book hard” price move is nearly invisible on the charts (which points to how high the leverage was).

As expected, the universal media comment is that this is time to buy the dip. Then again, without a GME like buyer, is the fair market price really $40, $80 or $20 for DISCA (or $100, $48 or $30 for VIAC)? That one fund can move prices down (but more importantly up) so much is disturbing.

Given that TSLA’s sub $100 to $900 move was after the robo-taxi presentation in which Musk explicitly confirmed that they would attain level 5 autonomy by 2020 (which has been contradicted by TSLA legal counsel in their filings with the DMV in California where they expressly claimed only level 2 autonomy was the goal in their final product), I cannot help but think of Cathie Wood when I read about Bill Hwang’s fund. Even if less leverage is being used by any one fund, clearly the ability to lever up by 5 times implies other funds can blow up just as easily elsewhere. If the Musk presentation of level 5 autonomy was a fraud as claimed (Financelot on Twitter: “Elon Musk is aggressively going after the Tesla Self-Driving Scam video uploaded today and attempting to take it down everywhere. I’ve split it into parts, so hopefully this stays up for this evening. Special thanks to Pat for the copy (12 minutes) Part 1 of 5: https://t.co/1CFypIZhF6” / Twitter), how can TSLA remain priced for billions in sales and capabilities that will not be achieved according to their own legal filings?

I don’t get why people throw money at Cathie Woods. She’s just doing the exact same thing as any retail investor

LikeLike

https://twitter.com/muddywatersre/status/1446530117228957696 after seven months…

LikeLike

https://www.bloomberg.com/news/articles/2022-04-27/archegos-founder-hit-with-criminal-charges-in-massive-fund-rout

LikeLike