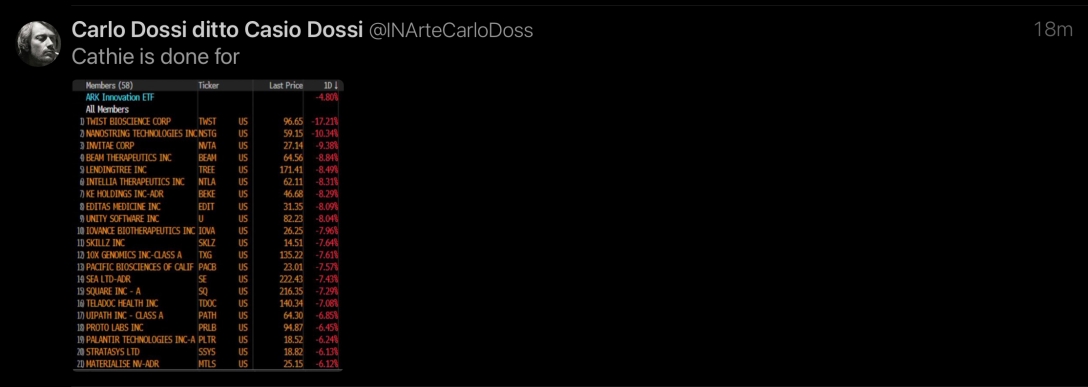

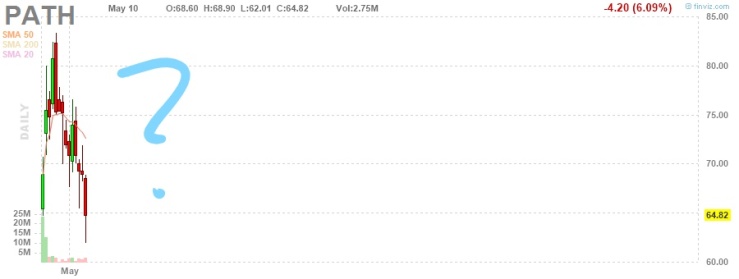

This tweet today (https://twitter.com/INArteCarloDoss/status/1391839660830339073) concerning ARKK Innovation ETF is interesting, whether you agree with the tweet or not, because although it ranks the top 21 names in the fund by their daily percentage loss at the time of the tweet (everything on the list fell today by more than -6%), if you look further in the names and pull up their charts you find that all of them had already peaked in February, around the time of Bill Hwang’s $20 billion dollar implosion (no surprise) and since that time they have been trending consistently down. The Bill Hwang/Cathie Wood connection is central to ARKK’s existence as he provided the seed capital to four of her ETFs at a time when traditional investors in these ETFs were put off. But more to the point these names are now below price boxes or other areas of support. And in breaching those support levels, they now seem to be exhibiting a negative feedback loop as selling begets more selling. I bring this up because a previous blog entry (The two price box problem – Felix qui nihil debet (wordpress.com)) mentioned the extreme risk in ARKK and its Neil Woodford style of risk management with its large relative positions in small illiquid names that make exiting their positions extremely difficult:

The poster child for the current bubble is, of course, ARKK and its TSLA fuelled run up. The fact that ARKK is negative for the year, breached three price boxes and closed, despite the day’s bounce off the morning lows by the market, in the third price box does not bode well. Predictions are always hazardous but not only is the price action discouraging, along with the ultra high short interest, but the LTCM/Neil Woodford school of risk management for this current largest inflow fund manager ($50B under management) underscores the risk in this market. Not only is there potential for redemptions to overwhelm liquidity, and with so many oversized exposures to illiquid and tiny issues where ARKK is the whale, but the SEC short swing rule 16 mentioned by the FT.com seems to be in play which would aggravate “frictions” in any attempt to generate liquidity. The only thing missing is r/Wallstreetbets touting ARKK.

ARKK was $117 at the time of the blog entry. Today it closed at $103.98, continuing May’s daily losses as it breached the lower parallel in early May (I remain short).

Morningstar (ARK innovation’s approach is ill-prepared: Morningstar (yahoo.com)) has already commented on ARKK’s relative standing compared to other ETFs in terms of risk management and investment manager experience, length of employment with the fund and relevant expertise (other funds employ PhDs with years of relevant experience to be able to analyse the scientific merits of their product pipeline for example).

But setting that aside, the most notable feature of this list from Twitter, and today’s focus is the consistent pattern of breakdown in the charts for all the names listed in the tweet.

The Neil Woodford negative feedback loop dynamic seems to have only accelerated since I wrote last about this risk. It is no coincidence that these equity names, and ARKK’s performance, peaked out at around the time of Bill Hwang’s implosion (with its subsequent reduction of leverage across the bucket shop space). The wider and more negative point is that first bubble stocks peaked, then the biggest Bitcoin vehicles peaked and now the joke Bitcoin vehicles are experiencing -40% drops after SNL. Is there anything left that is junkier pumped by celebrities?