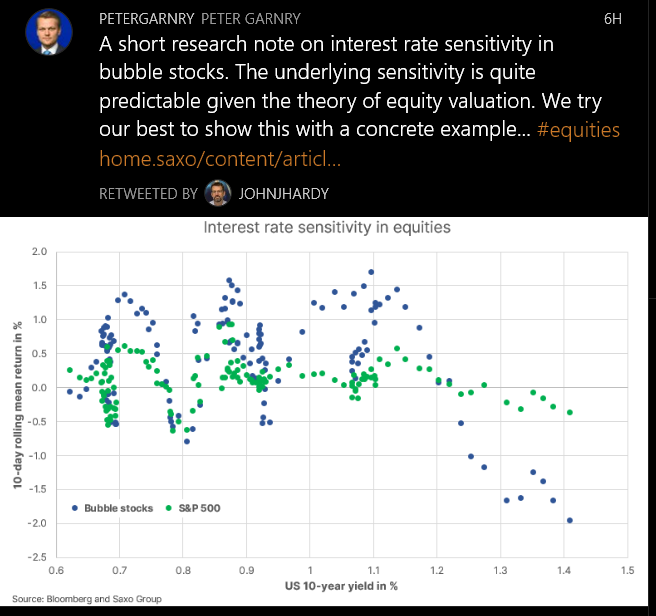

If the drop to week lows on Monday was due to the yield on 10 year treasuries rising above 1.5%, and the subsequent bounce on Tuesday and the rest of the week was due to a pause in that move, why are most bubble stocks at today's close higher compared to where they were Monday… Continue reading something is off

Author: Fraser

chart update after historic bounce

As a result of one of the biggest up days in months nearly every chart has bounced off either its lower parallel or price box with the notable exception of DASH (IPO lockup expiry could be weighing on price) and VALE (commodity euphoria is stalling?). But with 10 year treasuries expected to hit 2% by… Continue reading chart update after historic bounce

Chart update AAPL breaches lower parallel while QQQ is there

A lot has happened in one day: AAPL breached its lower parallel; given the path of bubble stocks that have already breached their lower parallel and have continued to go down, this only confirms the new trend (e.g., ABNB, AMD, AMZN, BE, BIDU, BLNK, CVNA, DASH, FCEL, NIO, NOW, OKTA, PDD, PLUG, PTON, PYPL, SHOP,… Continue reading Chart update AAPL breaches lower parallel while QQQ is there

The two price box problem

Last week posed a massive problem for momentum traders as the 10 year rates started to really get going. Despite Monday’s bump, what the market confronted last Friday was the first drop into a prior price box. QQQ had formed a $340/$320 price box in January to February but fell below that price box last… Continue reading The two price box problem

AAPL continues to represent the market well

Once again it feels like AAPL is the most important chart of the week (setting aside the 10 year treasuries of course). AAPL’s breach of the lower parallel, for the first time since September, is the key data point it seems. Following the leader, of course, a mass of stocks followed AAPL in either breaching… Continue reading AAPL continues to represent the market well

Protected: City of Legions Chapter 17: complicity and upgrade [draft]

A change in AAPL

AAPL is a good summary of the entire market at the moment as it has been in an upward channel since September, it had hit its upper parallel in late January and is now nearly at its lower parallel. We see the same sort of pattern in ABNB, AMD, AMZN, NFLX, and PTON, at least… Continue reading A change in AAPL

Is this the “permanently high plateau” article for TSLA or a hedge fund plant?

Yale’s economist Irving Fisher has the unfortunate distinction of being forever associated with his quote in early October 1929 by the New York Times that “Stock prices have reached what looks like a permanently high plateau.” By late October the stock market started the crash of 1929. When the fifth largest US stock by capitalisation… Continue reading Is this the “permanently high plateau” article for TSLA or a hedge fund plant?

Stepping back from the weekly review to the last 3 months

Many charts that I find interesting are up materially (the percentages next to the stock ticker are very rough as is the three month time frame). New highs seem to be consumer facing with disconnected valuations (e.g., SHOP price/sales is 71 versus AMZN p/s of 4): ABNB 80% in roughly 3 months (new highs),BIDU 100%… Continue reading Stepping back from the weekly review to the last 3 months

Sign of the bubble #15 (I have lost count): DASH nearly worth one SHW

DASH is worth $62B (sales $2B, income -$280M) and was up 14% today as I was short. What can you buy for $62B? Zurich Insurance, Deutsche Post, Intercontinental Exchange (sales $6B, income $2B), Ronseft, Norfolk Southern (sales $9.8B, income $2B), Brookfield Asset Management (sales $63B, income -$75M), Vmware (sales $12B, income $1.6B), London Stock Exchange,… Continue reading Sign of the bubble #15 (I have lost count): DASH nearly worth one SHW

Weekly chart review

The drop in mid-January has been completely erased in a lot of names in February in dramatic fashion with some of these issues, like WDAY, NOW and OKTA essentially going up every day in February. Other “innovation” names like UBER, LYFT, SHOP, PYPL, FCEL, BLDP and BE were very strong and making new highs. The… Continue reading Weekly chart review

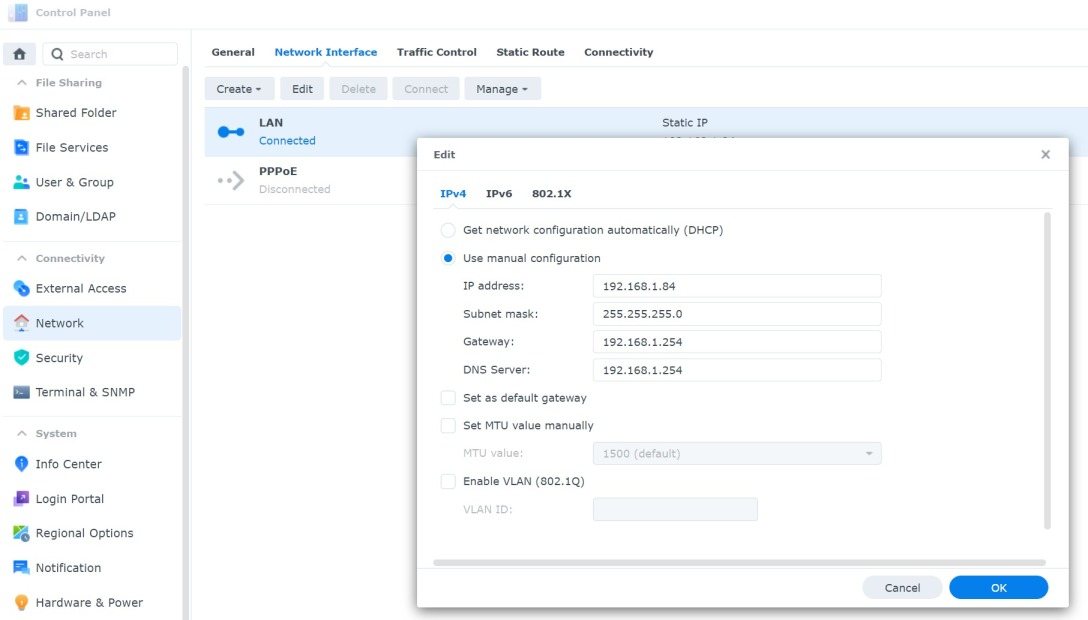

Possible solution for Synology NAS folder (or any SMB folder) disconnect issue in iOS

The one annoyance I was having with the excellent iA Writer for iOS was that my Synology NAS folders I had added to my LOCATIONS sidebar in iA Writer would not stay for more than a day or two. After a few days of use they would either disappear or, when I tried to select… Continue reading Possible solution for Synology NAS folder (or any SMB folder) disconnect issue in iOS

Risk off

As I have been writing about for some time, the market has been rolling over. If you have time for only one chart, pay attention to the S&P500 falling below its 21 day moving average of prices a few days ago and today breaching its 50 day moving average (and while the most unfortunate inclusion… Continue reading Risk off

How to set up duplicate YubiKeys with OpenPGP in 2021: computer security could be so much better right now

[With Addendum to chapter 8 regarding deleting all secret keys on the computer to improve security even further by confining secret keys to the YubiKey when using Kleopatra on the desktop] The fact that this blog entry is so long (or even necessary) is clear evidence of the abject failure of the computer industry to… Continue reading How to set up duplicate YubiKeys with OpenPGP in 2021: computer security could be so much better right now

A negative week in the markets (what’s that?)

On this first negative week in a long time there certainly does have the flavour of a trend change, at least based on Friday’s widely negative price action. But a chart of the VXX, not a perfect reflection of VIX but a good enough proxy for now, shows the volatility index still very much pinned… Continue reading A negative week in the markets (what’s that?)

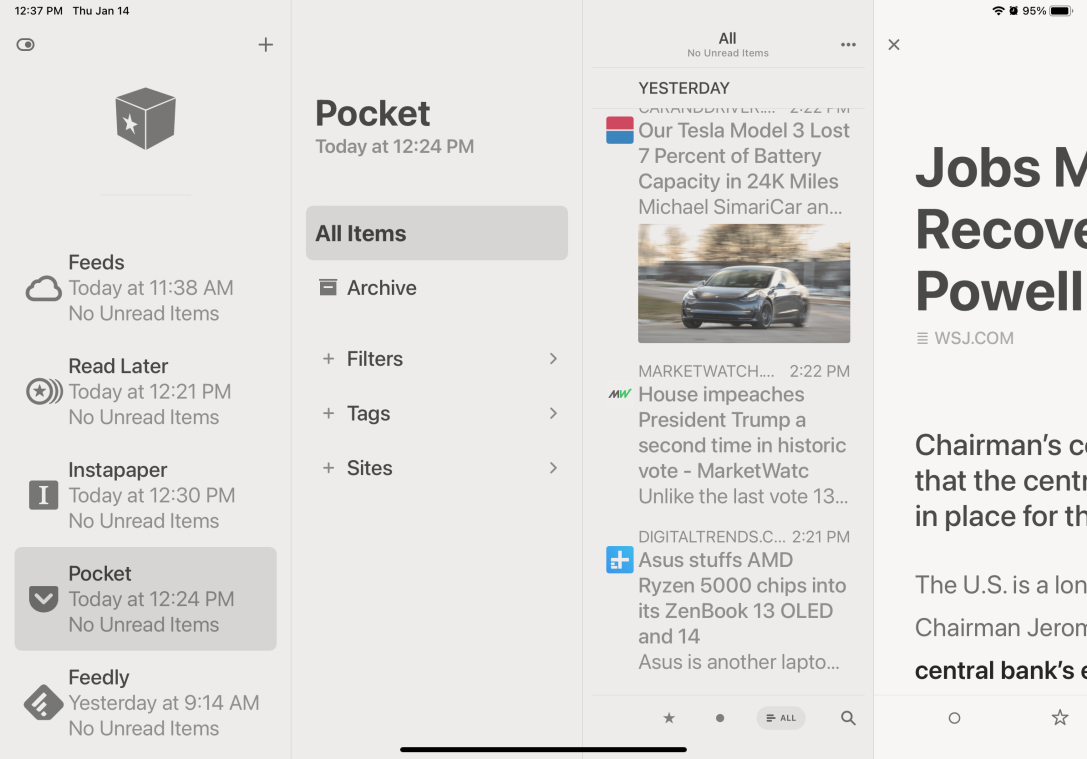

Rediscovering Reeder for iOS

Reeder 5 for iOS, a USD$5 purchase, improved my research workflow but two of the features that I discovered when upgrading turned out to have already be in Reeder 4 (which I have) but missed when I was using it. I guess sometimes it just takes spending the time to learn an app to get… Continue reading Rediscovering Reeder for iOS

Protected: City of Legions Chapter 16: trade and water [draft]

Curious divergence in bubble names from the rest of the market

While the broader indices are making new highs, it is very curious to see several bubble names break down out of their price box on no news (the charts are a bit behind closing prices). BYND was within a very narrow range of $145/$135 for over a month. Today, it is -7.53% and $126, a… Continue reading Curious divergence in bubble names from the rest of the market

Moving to WordPress

Of course Blogger has been a bit annoying for a while. My experience with WordPress, and its integration with the markdown editor iA Writer meant that I actually wanted to post new entries in WordPress instead of Blogger. So, I will keep my old entries online for now but for any new entries, please visit… Continue reading Moving to WordPress

QuantumScape (QS) trade analysis

I have become somewhat frustrated with Blogger and am thinking of moving my blog with over 500 posts over to WordPress. While the old blog remains, I will leave a note that my new entries will likely end up here on WordPress (which is not ideal as my creative writing entries are mixed in with… Continue reading QuantumScape (QS) trade analysis

Protected: City of Legions Chapter 15: Kristen [draft]

After over 500 posts, this is what Google thinks of my blog

Tiresome

Protected: City of Legions Chapter 14: takeover [draft]

Red alert: weekly review

Beanpole (2019)

The mystery of TSLA

still trying to figure this outAs I write this, TSLA now sits at $544B in market value with a p/e of 1,159, forward p/e of 150, p/s of 19.3, p/b of 34.23 and p/fcf of 128. Revenue is $28B with $525M in income, mostly due to regulatory credits.GM, by way of contrast, has $65B in… Continue reading The mystery of TSLA

Protected: City of Legions Chapter 13: the return [draft]

Weekly chart review

wedges are commonA lot of the tech names are forming wedges and are either breaking down from them or are just very flat in this week. Apple is at the upper end of its very narrowing wedge. This sort of chart formation is similar to that in AMD, less so in Amazon, CVNA, MSFT, a… Continue reading Weekly chart review

Protected: City of Legions Chapter 12: why the bother [draft]

Typora markdown editor

As excellent as iA Writer for iOS is on the iPad (and Android), recently I have found myself spending more time using an outstanding markdown editor called Typora on Windows (the experience is also excellent on Ubuntu). What separates the iA Writer type writing experience from Word is the ability to use the same focus… Continue reading Typora markdown editor

Protected: City of Legions Chapter 11: undone by tea [draft]

Protected: City of Legions Chapter 10: how to find the missing [draft]

Protected: City of Legions Chapter 9: bloody Shakespeare [draft]

Weekly review: breach of the lower parallel is the theme of the week

breach of the lower parallelThis was an unusual week, to say the least, as we've had such a big drop after almost 2 months of intermittent erosion in the market. I think it is useful to look at the different classes of price behaviour and sort out stocks based on how they are acting. While… Continue reading Weekly review: breach of the lower parallel is the theme of the week

This is the first day that the bubble names actually went down with the market in a while

Catching upQQQ has been correcting since mid October (or really September): double topSomeone was buying ZM at $550 this morning. It quickly reversed its gains and went negative with the rest of the market (ignoring GE and its earnings result), really the first time it actually responded to what has been a steady decline since… Continue reading This is the first day that the bubble names actually went down with the market in a while

Protected: City of Legions Chapter 8: a new man [draft]

There is no excerpt because this is a protected post.

Protected: City of Legions Chapter 7: abduction on the side [draft]

There is no excerpt because this is a protected post.

Protected: City of Legions Chapter 6: the best job in the world [draft]

There is no excerpt because this is a protected post.

New leadership

leader?While the old leaders like AAPL, AMZN, FB, MSFT or TSLA are decidedly flattish (they can never be permitted to fall of course but they look rather anaemic), new issues seem to have attracted a bid this month as fuel cell names like BE, PLUG, BLDP and a weird mix of names such as BYND,… Continue reading New leadership